The execution rate is the number of shares bought back as a percentage of the total number of shares in the plan. If the execution rate is high, the company is actively buying back shares; if it is low, it may have reservations about the market. Retired shares are treasury shares that have been repurchased by the issuer out of the company’s retained earnings and permanently canceled. While other treasury shares can be reissued or sold on the open market, retired shares cannot be reissued, they have no market value and they no longer represent a share of ownership in the issuing corporation. Retired shares will not be listed as treasury stock on a company’s financial statements.

- Treasury stock can be made available for employee incentive plans or reissued for sale to the public, whereas retired shares are canceled and cannot be used for any purpose.

- Ask a question about your financial situation providing as much detail as possible.

- However, this strategy plays a crucial role in boosting shareholder value, stabilising stock prices, and even defending against potential takeovers.

- Thus, one way the corporation can avoid dividend restrictions is to purchase treasury stock.

- This sum is debited from the treasury stock account, to decrease total shareholders’ equity.

- In order to make the callable shares marketable, the corporation typically agrees to pay (at the time of call) not only par value but also an amount in excess of par known as the call premium.

Do I Have To Sell My Shares in a Buyback?

By accumulating treasury stock, they have the means to make good on these contracts down the road. A company can decide to hold onto treasury stocks indefinitely, reissue them to the public, or even cancel them. Here, the cost method neglects the par value of the shares, as well as the amount received from investors when the shares were originally issued. To calculate the fully diluted number of shares outstanding, the professional invoice design standard approach is the treasury stock method (TSM). By increasing the value of the shareholders’ interest in the company (and voting rights), the repurchase of shares helps fend off hostile takeover attempts. If the company’s share price has fallen in recent periods and management proceeds with a buyback, doing so can send out a positive signal to the market that the shares are potentially undervalued.

Constructive Retirement Method

If the cost method is used, the entry is the same as for retirement except that the Treasury Stock account is credited instead of the Cash account. Accounting for the retirement of treasury stock depends on the original issue price and the price that must be paid to retire it. Treasury stock can be reissued in the future for various purposes, such as employee stock option plans, acquisitions, or raising capital. Holding shares in reserve gives the company flexibility in managing its capital structure without having to issue new shares. Buying back shares can improve key financial metrics, particularly EPS, which is calculated by dividing net earnings by the number of outstanding shares. A lower number of outstanding shares can significantly boost EPS, making the company appear more profitable, even if overall earnings remain constant.

Advantages of retirement of shares

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. This situation is typically encountered only in companies with relatively few stockholders. Some companies have issued mandatory redeemable stock, which must be turned into the company by a specific date. After appropriate approvals, the corporation may act to acquire shares for the purpose of retiring them.

What includes in the journal entry of acquisition and retirement?

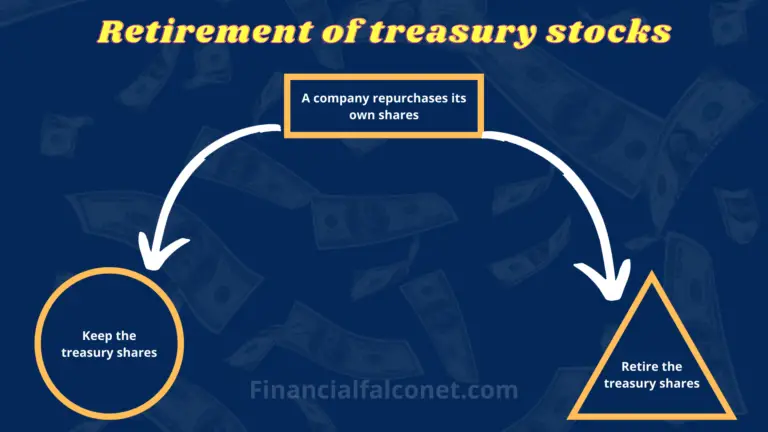

When a business is first established, its charter will cite a specific number of authorized shares. After a repurchase, the journal entries are a debit to treasury stock and credit to the cash account. However, the treasury stock tends to be bought back at a higher price than it was originally issued. Hence, there will usually be a difference between the amount received from issuing the stock and the cost of buying it back. Occasionally, a corporation’s board of directors will vote to execute a special purchase of non-callable stock with the express purpose of retiring the shares rather than holding them indefinitely as treasury stock. If allowed by state laws and the corporation’s bylaws, the board of directors can vote to retire shares of stock.

After buyback

Shares bought back or held by a company fall into one of these two categories. Ask a question about your financial situation providing as much detail as possible. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Some shareholders’ shorter-term horizons may not view the event as a positive. The stock’s earnings per share thus increases while the price-to-earnings ratio (P/E) decreases. A share repurchase can demonstrate to investors that the business has sufficient cash set aside for emergencies and a low probability of economic troubles. The two aspects of accounting for treasury stock are the purchase of stock by a company, and its resale of those shares. If a company has purchased treasury shares at a total cost of $25 per share, then sells those shares for $24, this transaction would cause an increase in Revenues and a decrease in Cash. The Additional Paid-in Capital account is credited for the economic gain because current accounting and tax rules do not allow corporations to record a profit and, in this way, increase retained earnings by dealing in its own stock.

We will discuss more on the differences and similarities between treasury shares and retired shares later. In this case, there will be no treasury stock account included in the journal entry. The common stock APIC account is also debited to decrease it by the amount originally paid over the par value by the shareholders.

In effect, the company’s excess cash sitting on its balance sheet is utilized to return some capital to equity shareholders, rather than issuing a dividend. The rationale for share repurchases is often that management has determined its share price is currently undervalued. Share repurchases – at least in theory – should also occur when management believes its company’s shares are underpriced by the market. Therefore, an increase in treasury stock via a share buyback program or a one-time buyback can cause the share price of a company to “artificially” increase. Given the information above, let us show some examples for the issuing, repurchase and retirement of common stock journal entry. Let’s assume Duzzlag Engineering and Construction Company issued 10,000 shares at $15 per share and a par value of $10.