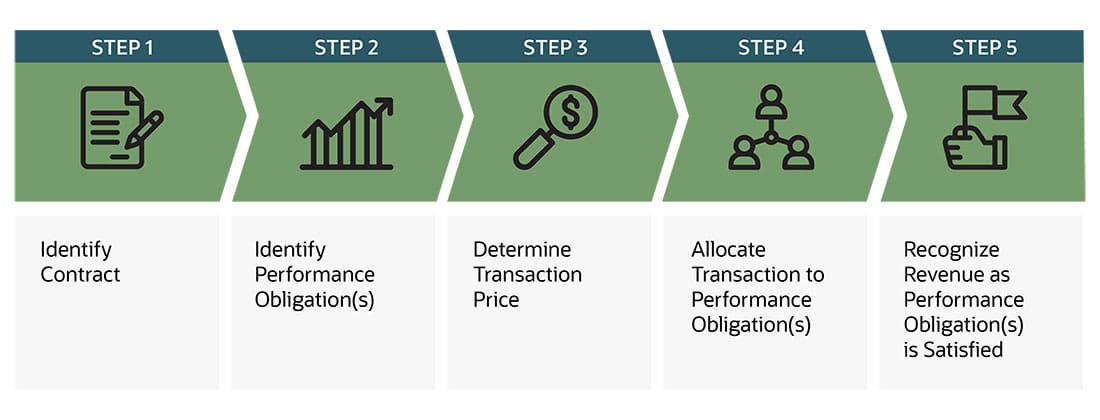

There’s no denying that the ASC 606 and IFRS 15 framework, in concert with GAAP, has made revenue recognition a key compliance consideration for many companies. However, when done manually, it’s still a tremendously tiresome and monotonous ordeal filled with many complexities and nuances. It’s important to note that revenue recognition can vary between industries despite the frameworks provided by GAAP, ASC 606, and IFRS. This is one reason why partnering with a service like RightRev that offers revenue recognition automation can be invaluable—simplifying all the complexities around revenue recognition.

Gift Card Revenue Recognition

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Led by editor-in-chief, Kimberly Zhang, our editorial staff works hard to make each piece of content is to the highest standards. Our rigorous editorial process includes editing for accuracy, recency, and clarity. And if it’s not done perfectly, your business can legally end up in hot water.

Great! The Financial Professional Will Get Back To You Soon.

For instance, under the accrual basis of accounting, revenue is recognized when it is earned, regardless of when the cash is received. This means that a company might recognize revenue from a sale even if the payment is expected in the future. Another credit transaction that requires recognition is when acustomer pays with a credit card(Visa andMasterCard, for example). This isdifferent from credit extended directly to the customer from thecompany. In this case, the third-party credit card company acceptsthe payment responsibility.

- This principle ensures that businesses only recognize revenue when they have actually earned it, which helps to provide a more accurate picture of their financial situation.

- While these terms are often used interchangeably, they represent different stages in the accounting process.

- At this point, the entity is generally entitled to receive the revenue because the value of goods and services sold to the buyer can be objectively measured and the earning process is completed.

- Auditors must be aware of the limitations of the realization concept and be diligent in monitoring financial transactions to ensure accuracy and compliance with generally accepted accounting principles.

- This alignment helps in presenting a clear and consistent view of profitability over time.

What’s the difference between Realization and Recognition Principle?

The realization concept is an important principle of accounting that seeks to ensure that income and expenses are recognized when they are earned or incurred. The realization concept not only allows businesses to gain a more comprehensive understanding of their financials but also provides customers with more payment options. This could lead to an increase in customer satisfaction, as customers have more control over the payment process.

Realized Gain

These frameworks ensure that public sector financial statements provide a true and fair view of the entity’s financial position, enabling better accountability and transparency. The credit card company charges Jamal’s Music Supply a3% fee, based on credit sales using its card. From the followingtransactions, prepare journal entries for Jamal’s Music Supply. Revenue recognition is a generally accepted accounting principle (GAAP) that identifies the specific conditions in which revenue is recognized and determines how to account for it. Revenue is typically recognized when a critical event has occurred, when a product or service has been delivered to a customer, and the dollar amount is easily measurable to the company. For most CFOs and accountants, Generally Accepted Accounting Principles (GAAP) are like the holy grail of accounting—mastered and internalized over years of heavy usage and application.

Which of these is most important for your financial advisor to have?

Calculating the exact amount of revenue you’ve realized can be done using different methods depending on the nature of the contract or sale. In the case of services or investment, it is to be recognized when income is accrued. Fourth, the transaction price shall be allocated to each corresponded performance obligation.

Accounts receivable is considered anasset, and it typically does not include an interest payment fromthe customer. If the company has provided the product orservice at the time of credit extension, revenue would also berecognized. In accounting, recognition refers to the process of acknowledging and recording a financial transaction in the bookkeeping records and then transferring it to the financial statements as an asset, liability, income, or expense. It is extremely important to decide when the organization’s revenues should be recognized as received. In its most general terms, both GAAP and IAS/IFRS assume that revenues are recognized when they are realized and earned.

This will help the accountant identify the business transactions from the personal ones. All forms of business organizations (proprietorship, partnership, company, AOP, etc) must follow this assumption. Financial Accounting both practical and theory-based how should discontinued items be presented on the income statement is built on some accounting principles. And these accounting principles are built on a few assumptions that we call accounting concepts. These thirteen accounting concepts find wide acceptance across the world by accounting professionals and auditors.

Additionally, by providing customers with more payment options, businesses may be able to increase their sales. To understand the Realization Principle more clearly, consider the common business practice of selling goods on credit. When a company sells a product on credit, it has fulfilled its part of the transaction by delivering the product. As long as there’s a reasonable expectation that the customer will pay, the company can recognize the sale as revenue, even if the payment will be received at a later date.